The Bank Nifty, also known as the Nifty Bank Index,

is a prominent sectoral index on the National Stock Exchange (NSE)

of

Comprising up to 12 major banking stocks, including public

and private sector banks, it reflects the health of

This comprehensive guide explores what Bank Nifty is, its current share price, predictions for today and tomorrow, open interest (OI) data, max pain theory, TradingView insights, the NSE Bank Nifty option chain, and live chart analysis.

Whether you're a beginner or an experienced trader, this article provides

actionable insights to navigate the dynamic world of Bank Nifty trading.

What is Bank Nifty?

The Bank Nifty Index is a weighted index calculated using the free-float market capitalization method. This means that only the shares available for public trading (excluding promoter-held shares) are considered for determining the index value.

The index is reconstituted semi-annually to ensure it reflects the evolving

dynamics of the Indian banking sector. It is governed by a three-tier

structure, including the Board of Directors of NSE Indices Limited,

the Index Advisory Committee (Equity), and the Index

Maintenance Sub-Committee.

Key Features of Bank Nifty

·

Composition: Includes up to 12

banking stocks, such as HDFC Bank, ICICI Bank, State Bank of India (SBI), Axis

Bank, and Kotak Mahindra Bank, among others.

·

Eligibility Criteria: Stocks

must be part of the Nifty 500, belong to the banking sector,

have a trading frequency of at least 90% in the past six months, and a listing

history of at least six months. They must also be tradable in the Futures

and Options (F&O) segment.

·

Applications: The index serves

as a benchmark for index funds, exchange-traded funds

(ETFs), and structured products. It is also widely

used in the F&O market due to its high liquidity.

·

Variants: The Nifty

Bank Total Returns Index accounts for dividends, making it ideal for

long-term investment strategies.

Why is Bank Nifty Important?

The Bank Nifty is a vital indicator of the Indian economy’s financial health, as banks play a pivotal role in economic growth. Movements in the index are closely watched by investors, traders, and policymakers.

Its high trading volume in the F&O segment makes it a favorite among

derivatives traders, while its diversified composition offers insights into

both public and private banking performance.

Bank Nifty Share Price Today

As of April 2025, the Bank Nifty share price

(index value) fluctuates based on real-time market dynamics. To get the exact

share price, you can check platforms like NSE India, Moneycontrol,

Groww, or TradingView. For instance, on April 2025, the Bank Nifty closed at 55,364.00, down by

-283.20 (-0.51%), according to Trendlyne. However, intraday

movements can vary significantly due to market sentiment, global cues, and

macroeconomic factors.

Factors Influencing Bank Nifty Share Price

1. Banking

Sector Performance: Earnings reports, non-performing assets (NPAs),

and credit growth of major banks like HDFC Bank or SBI directly impact the

index.

2. Macroeconomic

Indicators: Interest rate changes by the Reserve Bank of India

(RBI), inflation data, and GDP growth influence banking stocks.

3. Global

Cues: International market trends, foreign institutional investor

(FII) flows, and geopolitical events can cause volatility.

4. Market

Sentiment: Bullish or bearish trends in the broader Nifty 50

index often correlate with Bank Nifty movements.

To track the live Bank Nifty share price, visit:

·

NSE India: www.nseindia.com

·

Moneycontrol:

www.moneycontrol.com

·

Groww Terminal: groww.in

Today Bank Nifty Prediction:

Predicting the Bank Nifty’s movement for today requires

analyzing technical indicators, market sentiment, and recent trends. Based on

recent data and insights from TradingView and other platforms, here’s a

detailed prediction for April 24, 2025:

Technical Analysis

·

Current Trend: The Bank Nifty

has shown a bullish bias in recent weeks, with a 13.63%

gain in the last quarter and a 15.52% increase over the past

year as of April 2025. However, a -0.51% drop on

April suggests caution.

·

Support Levels: Key support

lies at 54,050–54,500, where the index may find buying

interest if it declines.

·

Resistance Levels: Immediate

resistance is at 55,450–55,550. A breakout above 55,550

could trigger a rally toward 55,950+.

·

Indicators:

o

Relative Strength Index (RSI):

If the RSI is near 70, the index may be overbought, signaling

a potential pullback. Conversely, an RSI below 30 indicates

oversold conditions.

o

Moving Averages: The 5-day

and 20-day moving averages can provide insights into short-term

trends. A bullish crossover (short-term MA crossing above long-term MA) is a

positive signal.

o

Volume Weighted Average Price (VWAP):

Intraday traders use VWAP to identify optimal entry and exit points.

Market Sentiment

·

FII/DII Activity: Strong buying

by Foreign Institutional Investors (FIIs) or Domestic

Institutional Investors (DIIs) can drive the index higher.

·

Global Markets: Positive cues

from Wall Street or Asian markets may support a bullish opening.

·

News Events: RBI policy

announcements, banking sector reforms, or corporate earnings can influence

intraday movements.

Today’s Prediction

Based on recent TradingView analysis, the Bank Nifty is expected to open flat

to slightly gap-up on April 24, 2025. If it sustains above 55,550,

a bullish rally toward 55,950–56,200 is possible. However,

failure to hold 54,500 could lead to a decline toward 54,050.

Traders should monitor the first 15 minutes of trading

(9:15–9:30 AM IST), as this period often sets the tone for the day.

Disclaimer: Market predictions are speculative and subject

to volatility. Always conduct your own research or consult a financial advisor.

Bank Nifty Prediction for Tomorrow:

Predicting the Bank Nifty’s movement for tomorrow involves

analyzing current trends, open interest data, and upcoming events. Here’s a

detailed forecast for April 25, 2025:

Key Factors to Watch

1. Closing

Levels on April 24: If the index closes above 55,550

on April 24, it signals bullish momentum for the next day. A close below 54,500

may indicate bearish pressure.

2. Option

Chain Data: High open interest at specific strike prices can reveal

potential support and resistance levels for tomorrow.

3. Global

Cues: Overnight developments in global markets, such as U.S. Federal

Reserve announcements or Asian market trends, will influence the opening.

4. Technical

Patterns: Patterns like descending channel breakouts

or Elliott Wave formations can provide clues. For instance,

TradingView analysts note that the Bank Nifty is in an impulse Wave 3,

suggesting strong bullish momentum.

Tomorrow’s Prediction

Based on current trends, the Bank Nifty is likely to exhibit range-bound

to slightly bullish behavior on April 25, 2025. If the index breaks

above 55,550 on April 24, it could target 56,200–56,500

tomorrow. Conversely, a drop below 54,500 may lead to a test

of 54,000–53,950. Traders should watch for gap-up

or gap-down openings, as these can trigger significant

intraday moves.

Pro Tip: Use 5-minute candlestick charts

and combine them with EMA, and CPR Ponits for precise entry and exit points.

| Best Stocks to Buy/Hold/Sell | Best Stocks to Buy/Hold/Sell |

|---|---|

| Au Bank Share Price Target 2025 | |

| Bandhan Bank Share Price Target 2025 | JPPower Share Price Target 2025 |

| ITC Share Price Target 2025 | Check GMP of IPO |

Bank Nifty Open Interest (OI) Data

Open Interest (OI) refers to the total number of

outstanding derivative contracts (futures or options) that have not been

settled. Analyzing Bank Nifty OI data provides insights into

market sentiment, support and resistance levels, and potential price movements.

Platforms like NiftyTrader, Upstox, and NSE Option Chain

offer real-time OI trackers.

How to Interpret OI Data

·

High OI at Call Strikes:

Indicates strong resistance, as institutional investors often write (sell) call

options at these levels. For example, if the 55,000 Call has the

highest OI, it may act as a resistance zone.

·

High OI at Put Strikes:

Suggests strong support, as put writing indicates bullish sentiment. For

instance, significant OI at the 54,000 Put could signal

support.

·

Change in OI: Rising OI with a

price increase confirms bullish sentiment, while rising OI with a price

decrease suggests bearish pressure.

·

Volume PCR (Put-Call Ratio): A

PCR above 1 indicates bearish sentiment (more puts traded), while a PCR below 1

suggests bullish sentiment.

Recent OI Trends

TradingView reported significant call

writing at 55,000 (16.60 lakh contracts) and put writing at 53,000

(13.51 lakh contracts) for the April expiry, indicating resistance at 55,100–55,200

and support at 54,000. As of April 2025, the OI for Bank

Nifty futures was 2,347,980 contracts, with a volume of 1,704,090,

suggesting high market participation.

How to Use OI Data

·

Support and Resistance:

Identify strike prices with high OI to plan trades. For example, buy calls near

support and puts near resistance.

·

Trend Confirmation: Combine OI

with price action to confirm bullish or bearish trends.

·

Straddle/Strangle Strategies:

Use OI to identify strike prices for volatility-based strategies like straddles

(buying call and put at the same strike) or strangles (buying OTM call and

put).

Where to Access OI Data:

·

NiftyTrader: www.niftytrader.in

·

Upstox: www.upstox.com

·

5Paisa: www.5paisa.com

Bank Nifty Max Pain

The Max Pain theory suggests that the stock or index price

tends to gravitate toward the strike price where the maximum number of options

(calls and puts) expire worthless, causing the least financial pain to option

writers (typically institutional investors). In the context of Bank

Nifty, max pain is a critical concept for options traders.

How to Calculate Max Pain

1. Collect

Option Chain Data: Gather OI data for all call and put strikes for the

current expiry.

2. Calculate

Loss for Each Strike: For each strike price, calculate the total loss

for call and put option holders if the index closes at that level.

3. Identify

Max Pain: The strike price with the least total loss for option

writers is the max pain point.

Significance of Max Pain

·

Price Magnet: The Bank Nifty

often closes near the max pain strike on expiry day, as option writers

manipulate prices to minimize their losses.

·

Trading Strategy: Traders can

use max pain to select strike prices for straddles or iron

condors, expecting the index to settle near this level.

Example

If the max pain strike for the weekly expiry is 55,000, the

Bank Nifty is likely to hover around this level as expiry approaches. Traders

can sell 55,000 straddles (call and put) to capitalize on time

decay, assuming low volatility.

Where to Find Max Pain Data:

·

NiftyTrader: Offers real-time

max pain calculations

·

ICICI Direct: Provides option

chain analytics

·

TradingView: Community scripts

may include max pain indicators

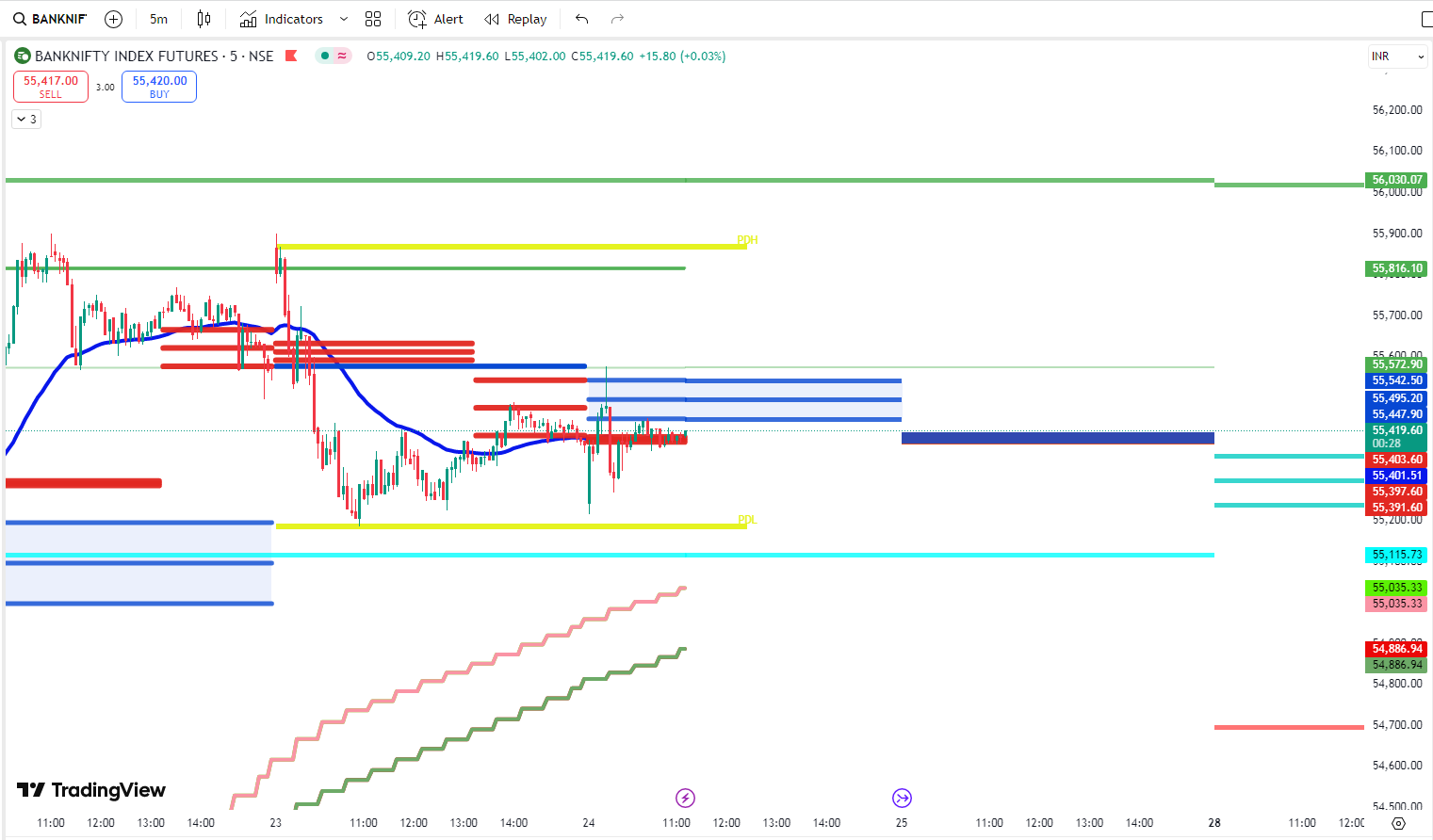

TradingView Bank Nifty Analysis

TradingView is a popular platform for technical analysis,

offering advanced charting tools, indicators, and community-driven insights for

Bank Nifty (NSE:BANKNIFTY). Traders use TradingView to analyze

price trends, identify patterns, and develop strategies.

Key TradingView Features for Bank Nifty

·

Live Charts: Access real-time

candlestick, line, or Heiken Ashi charts for intraday and long-term analysis.

·

Technical Indicators: Combine RSI,

MACD, Bollinger Bands, VWAP,

and Fibonacci retracement for precise trade setups.

·

Community Ideas: TradingView’s

community shares forecasts, such as intraday levels and Elliott

Wave analysis. For example, a recent post predicted a descending

channel breakout targeting 57,450+.

·

Custom Scripts: Use PineScript

to create custom indicators, like the Bank Nifty Market Breadth (OsMA),

which analyzes momentum in underlying stocks.

Recent TradingView Insights

·

April 21, 2025: Analysts

recommended using 5-minute candlestick charts with VWAP

to identify precise entry/exit points near support (54,050)

and resistance (55,450).

·

April 22, 2025: A flat

to slightly gap-up opening was expected, with a bullish rally above 55,550

targeting 55,950+.

·

Bearish Caution: Near all-time

highs, analysts advised avoiding fresh long positions without a pullback to key

support zones.

How to Use TradingView for Bank Nifty

1. Chart

Setup: Use 5-minute or 15-minute

charts for intraday trading and daily charts for positional

trades.

2. Indicators:

Combine RSI, MACD, and Bollinger

Bands to confirm trends. For example, a bearish MACD crossover

with RSI below 40 signals a potential short trade.

3. Community

Insights: Follow top authors for intraday plans, such as Vinaykumar

Hiremath, who provides Kannada-language analysis.

4. Backtesting:

Use TradingView’s replay feature to test strategies on historical Bank Nifty

data.

Access TradingView: www.tradingview.com or in.tradingview.com

NSE Bank Nifty Option Chain

The Bank Nifty Option Chain is a powerful tool for

derivatives traders, providing real-time data on call and put options across

various strike prices. It includes details like open interest,

change in OI, volume, last traded

price (LTP), and option Greeks (Delta, Vega, Theta,

Gamma).

Key Components of the Option Chain

·

Strike Price: The price at

which the option can be exercised.

·

Open Interest (OI): Total

number of open contracts, indicating market participation.

·

Change in OI: Shows whether

traders are opening or closing positions.

·

Volume: Number of contracts

traded at a specific strike.

·

Implied Volatility (IV):

Measures expected price swings, affecting option premiums.

·

Option Greeks: Help traders

assess risk and profitability.

How to Analyze the Option Chain

·

Support and Resistance: High OI

at a put strike (e.g., 54,000 Put) indicates support, while

high OI at a call strike (e.g., 56,000 Call) suggests

resistance.

·

Market Sentiment: A bearish

market shows falling call prices and rising put prices, while a bullish

market shows the opposite.

·

Trading Strategies:

o

Straddle: Buy a call and put at

the same strike to profit from volatility.

o

Iron Condor: Sell OTM calls and

puts to profit in a range-bound market.

o

Covered Call: Buy the

underlying index and sell a call to generate income.

Recent Option Chain Insights

On April 2025, the Bank Nifty futures price was 55,450.2,

with a day range of 55,459.15–55,903 and an OI of 2,347,980

contracts. Traders should monitor the option chain for the weekly

expiry (typically Thursday) to identify high-OI strikes.

Where to Access the Option Chain:

·

NSE India: www.nseindia.com

·

Groww: groww.in

·

Upstox: www.upstox.com

·

ICICI Direct:

www.icicidirect.com

Bank Nifty Live Chart Today

The Bank Nifty live chart provides real-time insights into

price movements, helping traders make informed decisions. Platforms like TradingView,

Groww Terminal, Investing.com, and 5Paisa

offer customizable charts with various indicators and timeframes.

How to Use Live Charts

·

Chart Types: Choose candlestick,

line, bar, or Heiken Ashi

charts based on your trading style. Candlestick charts are ideal for

identifying patterns like doji or engulfing.

·

Timeframes: Use 1-minute

or 5-minute charts for scalping, 15-minute

charts for intraday trading, and daily charts for swing

trading.

·

Indicators:

o

Bollinger Bands: Identify

overbought/oversold conditions.

o

MACD: Confirm trend direction

and momentum.

o

Fibonacci Retracement: Pinpoint

potential reversal levels.

·

Support/Resistance: Draw

horizontal lines at key levels (e.g., 54,050 support, 55,550

resistance).

Recent Chart Analysis

On April 2025, the Bank Nifty chart showed a -0.51%

decline, closing at 55,364.00. The index was near its

52-week high, prompting analysts to advise caution for fresh

long positions unless a pullback occurs. The 5-minute chart

with VWAP and RSI can help intraday traders

identify precise entry points.

Where to Access Live Charts:

·

TradingView:

www.tradingview.com

·

Groww Terminal: groww.in

·

Investing.com

·

5Paisa: www.5paisa.com

Trading Strategies for Bank Nifty

To succeed in Bank Nifty trading, combine technical

analysis, OI data, and option chain insights. Here are some popular strategies:

1. Intraday

Trading:

o

Use 5-minute candlestick charts

with EMA and CPR.

o

Enter long positions above resistance (e.g., 55,550)

and short positions below support (e.g., 54,050).

o

Set a stop-loss based on the

15-minute candle’s high/low.

2. Options

Trading:

o

Straddle: Buy a call and put at

the same strike (e.g., 55,000) before high-volatility events

like RBI announcements.

o

Iron Condor: Sell OTM calls

(e.g., 56,000 Call) and puts (e.g., 54,000 Put)

in a range-bound market.

o

Use max pain to select strikes

for expiry-day trades.

3. Positional

Trading:

o

Follow daily charts and Elliott

Wave analysis for long-term trends.

o

Hold positions if the index sustains above key

resistance (e.g., 55,550) for a target of 57,450+.

4. Risk

Management:

o

Limit risk to 1–2% of capital

per trade.

o

Use stop-losses and position

sizing to protect against volatility.

o

Avoid trading in the no-trade zone

(e.g., 51,743–51,925) to prevent whipsaws.

Common Mistakes to Avoid in Bank Nifty Trading

1. Overtrading:

Avoid taking multiple trades in a single session, especially in choppy markets.

2. Ignoring

OI Data: Failing to analyze option chain data can lead to misjudging

support/resistance.

3. Chasing

Highs: Buying near all-time highs (e.g., 55,364)

without confirmation increases risk.

4. Neglecting

Risk Management: Not setting stop-losses or over-leveraging can wipe

out capital.

5. Relying

on Tips: Avoid unverified trading tips; always conduct your own

analysis.

Conclusion

The Bank Nifty Index is a dynamic and liquid instrument for

traders and investors, offering opportunities in both cash and derivatives

markets. Understanding its composition, tracking the live share price,

analyzing OI data, leveraging max pain, and

using tools like TradingView and the NSE option chain

can enhance your trading success. While today’s prediction suggests a flat

to slightly bullish outlook, tomorrow’s movement will depend on

closing levels and global cues.

To stay ahead, monitor live charts, follow technical

indicators, and combine OI analysis with option

chain data. Always practice disciplined risk management and consult a

financial advisor before trading. With the right strategies, Bank Nifty trading

can be both profitable and rewarding.

Start Trading Bank Nifty Today:

·

NSE India: www.nseindia.com

·

TradingView:

www.tradingview.com

·

Groww: groww.in

·

Upstox: www.upstox.com

Disclaimer: Trading involves high risks, and past performance is not indicative of future results. Conduct thorough research and seek professional advice before investing.